sacramento property tax rate 2021

Two Family - 2 Single Family Units. This is the total of state county and city sales tax rates.

New Jersey Nj Tax Rate H R Block

Sacramento County Ca Property Tax Search And Records Propertyshark Business Property Tax In.

. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate. The California sales tax rate is currently. But the highest rate this year is in the Western.

2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143. For purchase information please see our Fee Schedule web page or contact the Assessors Office.

Sacramento County Stats for Property Taxes. 2021-22 1036 104 101036 1 Increase to base. This is the total of state and county sales tax rates.

The minimum combined 2022 sales tax rate for Sacramento County California is 775. The property tax rate in the. Total tax rate Property tax.

Citizens pay roughly 291 of their yearly income on property tax in Sacramento County. Business Property Tax In California What You Need To Know 3636 American River Drive Suite 200 M ap. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

The minimum combined 2022 sales tax rate for Sacramento California is. Start Your Search Here. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

Sacramento Property Tax Rate 2021. Ad Retrieve Property Tax Records Connected to Any Address. FISCAL YEAR ENDED JUNE 30 2021 CITY OF SACRAMENTO FACTS The City of Sacramento was founded in 1849 and is the oldest incorporated city in California.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Look Up Current Past Tax Amounts Along with the Countys Value Assessment. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

The documentary transfer tax is computed with the value of the interest or property conveyed exclusive of the value of any lien or encumbrance remaining thereon at the time of. The Sacramento sales tax rate is 1. TAX DAY NOW MAY 17th - There are -410 days left until taxes are due.

2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1. Median Property Tax Rates By State. Sacramento property tax rate 2021 Sunday May 29 2022 Edit.

As well as CA effective tax rates. Payments may be made by mail or in person at the county tax collectors office located at 700 h street. In 1920 city voters adopted a.

Property information and maps are available for review using the Parcel Viewer Application. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. The sacramento sales tax rate is.

Permits and Taxes facilitates the collection of this fee. An application must be filed with the Assessors Office in order to receive any of these benefits. View the E-Prop-Tax page for more information.

February 2021 On November 3rd Californians voted by a slim margin to pass Proposition 19 the Home Protection for Seniors Severely Disabled Families and Victims of. In 2019 the rate was 1737 last year. What is the sales tax rate in Sacramento County.

Start filing your tax return now. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519. Sacramento property tax rate 2021.

This tax has existed since 1978. On the commercial side the median rate in 2021 was 1739 down from 1750 a year ago. Base Year Value Transfer Application forms are available online or you may request a form by.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

Property Taxes By State Quicken Loans

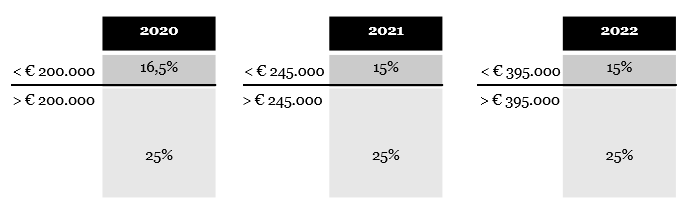

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Property Tax In San Diego The Rate When It S Late And Much More

The Average Property Tax Rates In California

Real Estate Market In Roseville Ca In Fall 2020 Kaye Swain Sun City Roseville Real Estate Marketing

Secured Property Taxes Treasurer Tax Collector

Lowering Auto Insurance Rates Stretcher Com Save Money No Matter What Your Credit Score Autoi Cheap Car Insurance Getting Car Insurance Car Insurance Tips

Cdp Bangalore Master Plan 2031 2015 Map Summary Download Master Plan How To Plan Map

Pin On 5 The Philadelphia Editor 2018 Edition

Missouri Income Tax Rate And Brackets H R Block

Housing In Infrastructure Bill Real Estate Agent And Sales In Pa Anthony Didonato Broomall Media Delaware Coun Infrastructure Sale House Real Estate News

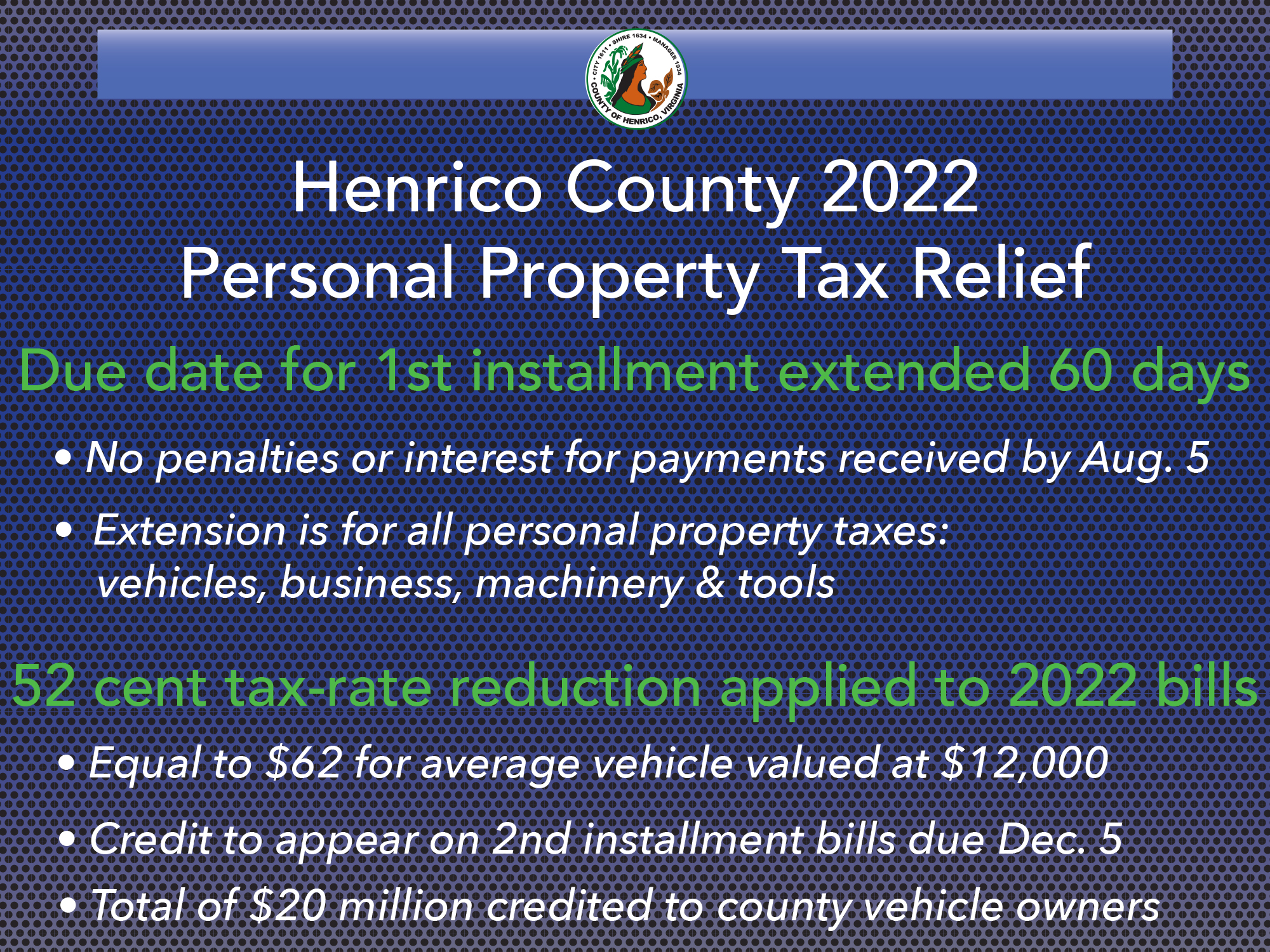

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Property Tax In San Diego The Rate When It S Late And Much More