japan corporate tax rate 2022

Standard enterprise tax and local corporate special tax. Where the annual taxable income exceeds CNY 1 million but does not exceed CNY 3 million inclusive the amount in excess of CNY 1 million.

Latvia Tax Income Taxes In Latvia Tax Foundation

Latest From The Web.

. August 02 2022 Hear More. The easiest way to do. Parents if you dont get a grip on your kids social media demonic trans activists will.

Since January 1 2018 the nominal federal corporate tax rate in the United States of America is a flat 21 due to the passage of the Tax Cuts and Jobs Act of 2017State and local taxes and rules vary by. Before 1 October 2019 the national local corporate tax rate was 44. Corporate tax is imposed in the United States at the federal most state and some local levels on the income of entities treated for tax purposes as corporations.

If our mission resonates with you please consider supporting our work financially with a tax-deductible donation. National local corporate tax. Harvard study wrecks insurrection narrative of Capitol riot.

For qualified small and thin-profit enterprises the annual taxable income up to 1 million yuan renminbi CNY inclusive is subject to an effective CIT rate of 25 from 1 January 2021 to 31 December 2022. Beginning from 1 October 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their corporate tax liabilities.

Corporation Tax Europe 2021 Statista

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

Korea Tax Income Taxes In Korea Tax Foundation

Business Capital Gains And Dividends Taxes Tax Foundation

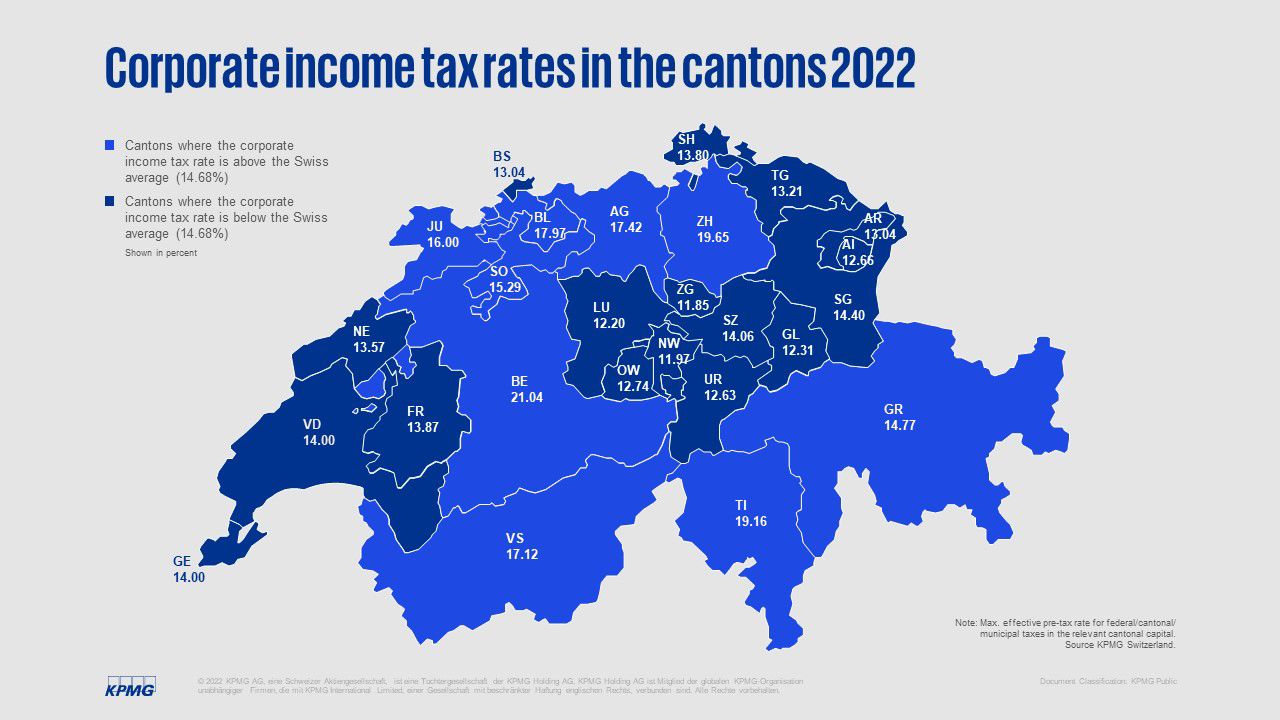

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

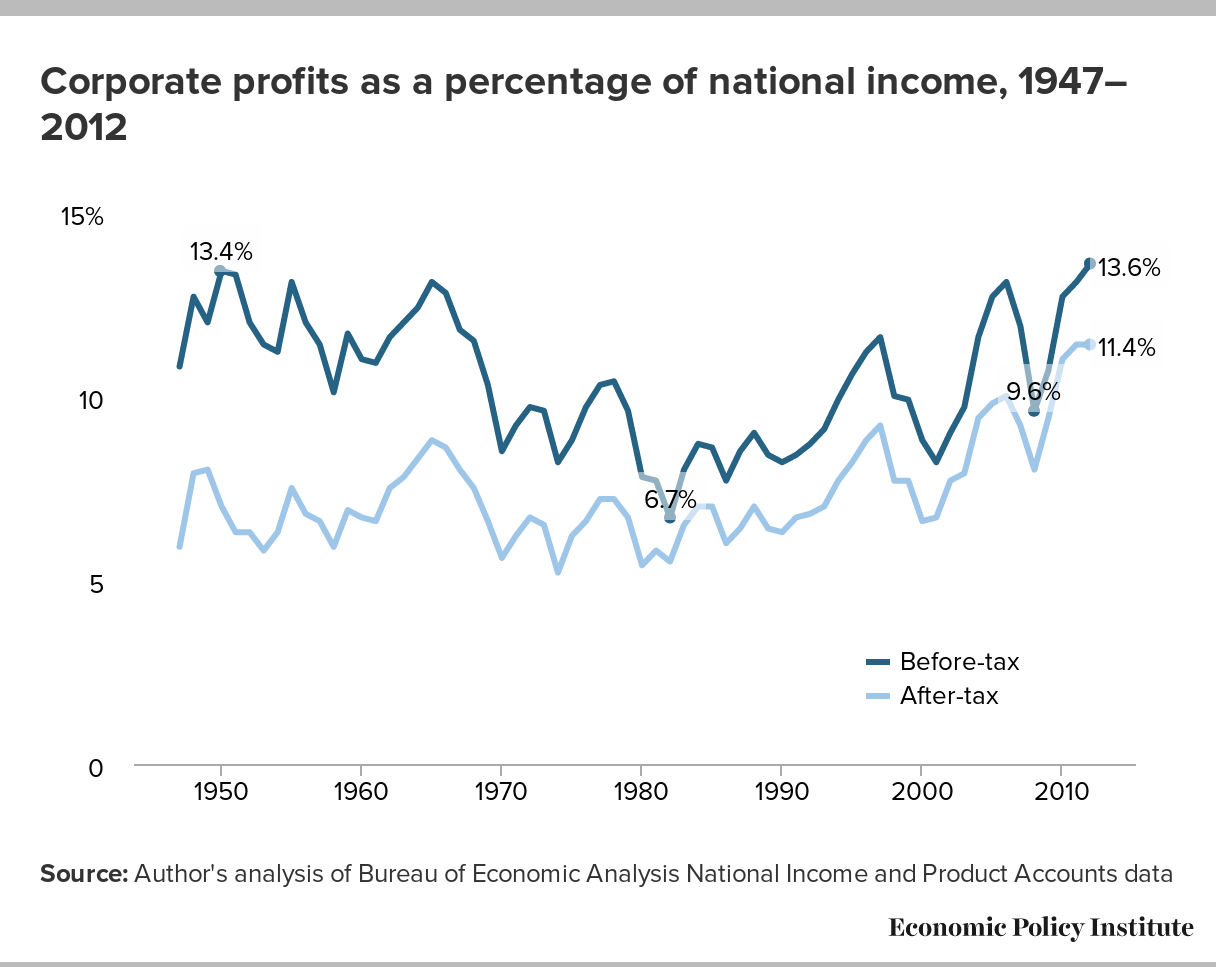

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Corporate Tax Reform In The Wake Of The Pandemic Itep

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Japan Cryptocurrency Tax Guide 2022 Kasō Tsuka Koinly

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Corporate Tax Reform In The Wake Of The Pandemic Itep

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

2022 Corporate Tax Rates In Europe Tax Foundation

Korea Tax Income Taxes In Korea Tax Foundation

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget