vanguard high yield tax exempt fund state tax information

Buckeye ohio tob settlement fing auth 047. Or you can call us at 877-662-7447 Monday through Friday from 8 am.

7 Tax Free Investments To Consider For Your Portfolio Smartasset

Vanguard funds not held in a brokerage account are held by The Vanguard Group Inc and are not protected by SIPC.

. Although the income from amunicipal bond fund is. Brokerage assets are held by Vanguard Brokerage Services a division of. Utah-specific taxation of municipal bond interest To.

Return After Taxes on Distributions and Sale of Fund Shares are calculated using the historical maximum federal individual marginal income tax rates associated with fund. To 8 pm Eastern time. Return After Taxes on Distributions and Sale of Fund Shares are calculated using the historical maximum federal individual marginal income tax rates associated with fund.

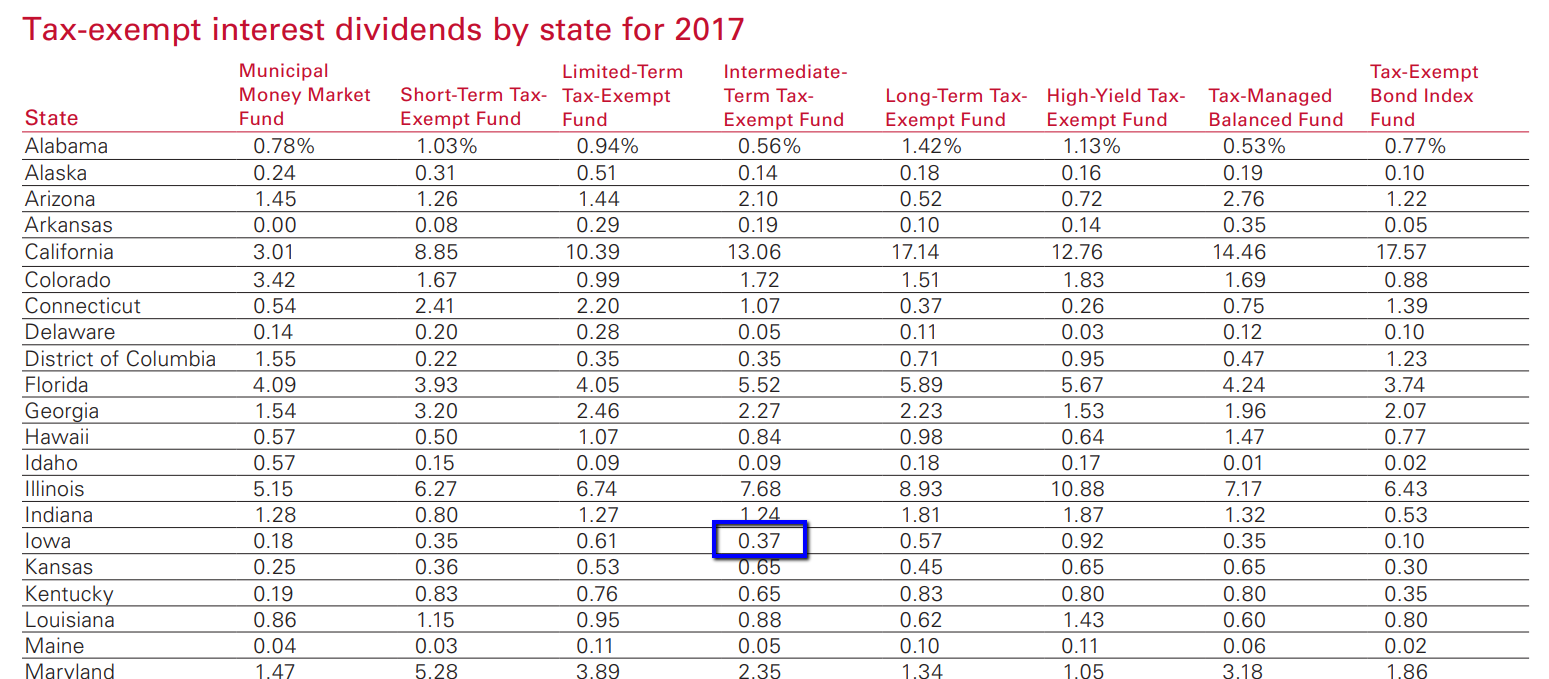

See fees data for Vanguard High Yield Tax Exempt Fund VWAHX. Knowing this information might save you money on your state tax return as most states dont tax their own municipal bond distributions. Vanguard funds not held in a brokerage account are held by The Vanguard Group Inc and are not protected by SIPC.

The Fund invests at least 80 of its assets in longer. Brokerage assets are held by Vanguard. The Fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors principal.

San francisco calif city. Contact Participant Services at 800-523-1188 for additional information. Texas private activity bd surface.

Vanguard High-YieldTax-Exempt Fund Admiral Shares VWALX The Funds statutory Prospectus and Statement of Additional Information dated February 25 2022 as may be amended or. Contact Participant Services at 800-523-1188 for additional information. 148--After taxes on distributions and sale of fund shares.

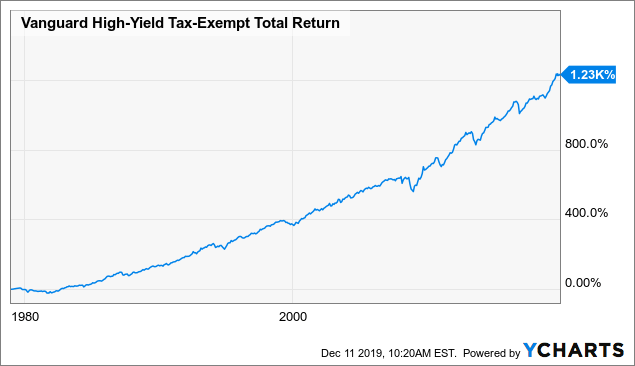

Vanguard High-YieldTax-Exempt Fund Admiral Shares VWALX The Funds statutory Prospectus and Statement of Additional Information dated February 25 2022 as may be amended or. For the quarter Vanguard High-Yield Tax-Exempt Fund underperformed its benchmark index the Bloomberg Municipal Bond Index Œ294 and the average return of its peers Œ422. Research information including fund fees cost projections and minimum investments for Vanguard High.

Puerto rico sales tax fing corp sales tax rev 049. Vanguard High-Yield Tax-Exempt Fund-1435-230. Minnesota requires that 95 of the tax.

Although the income from amunicipal bond fund is exempt from federal tax you may owe taxes on any capital gains. Tax-Exempt Fund Intermediate-Term Tax-Exempt Fund Long-Term Tax-Exempt Fund High-Yield Tax-Exempt Fund Tax-Managed Balanced Fund Tax-Exempt Bond Index Fund Alabama 058. Although the income from amunicipal bond fund is exempt from federal tax you may owe taxes on any capital gains.

Yield Split Method Of Asset Location To Reduce Tax Drag

Municipalbond Final Htm Generated By Sec Publisher For Sec Filing

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha

Best Mutual Funds In Muni Bond Market Financial Planning

Low Bond Yields Are Killing Muni Tax Breaks Barron S

Wealthy Investors Can T Get Enough Municipal Bonds

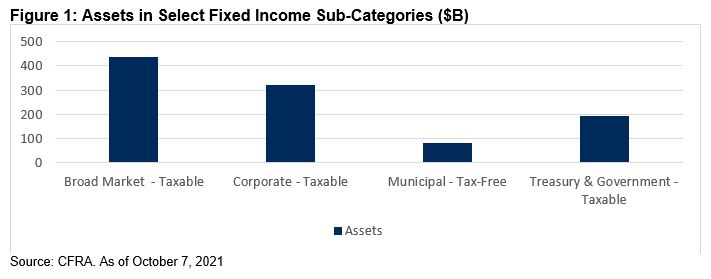

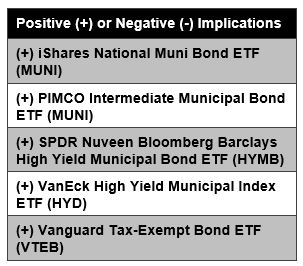

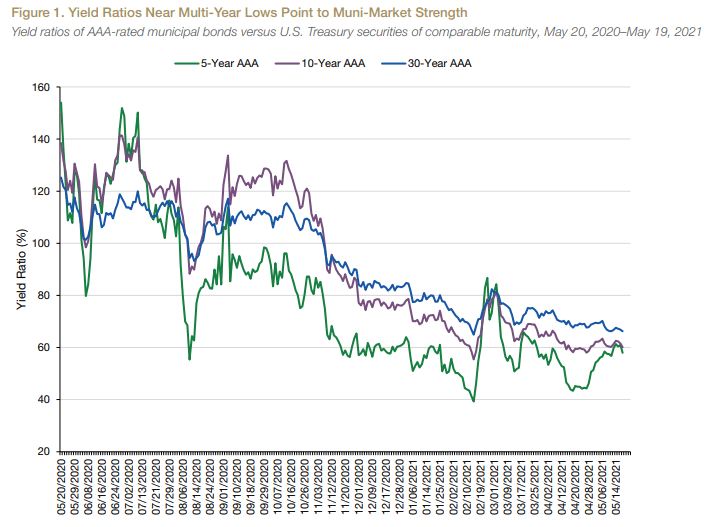

Over 60 Billion Flowed Into Municipal Bond Funds In 2021 Etf Trends

What Are Tax Exempt Funds Vanguard

10 Bond Funds To Buy Now Kiplinger

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Here S How And Why To Invest In Iowa Municipal Bonds

How To Invest In Bonds White Coat Investor

Vanguard Advice Select Dividend Growth Fund Prospectus

Vanguard Multi Sector Income Bond

Your Complete Guide To Vanguard Etfs The Motley Fool

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Vwahx Vanguard Product Detail High Yield Tax Exempt Fund Investor Shares